Australia has a pretty decent system of resolving liability for personal injuries that result from road crashes.

But what if the car that ran a red and bounced you onto the road was self-driving? And wasn’t carrying any humans. And wasn’t keen to exchange details.

This conundrum is currently keeping the elves very busy in various state and federal agencies, insurance companies, and legal firms.

The federal government is leading a review that focuses on "high-level reform that enables people injured or killed to access care, treatment, benefits and compensation when involved in an automated vehicle crash.”

It turns out that there are plenty of legal and jurisdictional hurdles in the way.

Current laws are state-based, and not only are they markedly different from state to state, but they are generally designed to cover injuries caused by human error rather than the failure of an inattentive algorithm.

A driverless car is a machine and cannot be negligent because it has no mental capacity to act with reasonable care and skill, according to the paper.

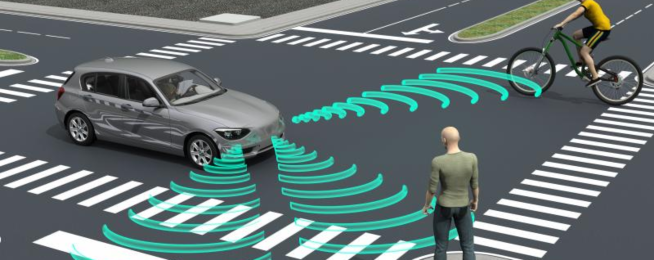

"ADS crash injuries are more likely to be the result of faults in software, sensors and communication systems,” the paper says.

"These systems could be both inside and outside the automated vehicle and may be susceptible to programming errors and external interference.”

“Motor accident insurance schemes are generally designed to cover injuries caused by human error rather than product faults."

The solution, according to a new policy paper from the National Transport Commission, is to reform accident insurance schemes in each state and territory to provide access for personal injuries and deaths caused when automated driving systems are engaged.

Stakeholders considered that the option ensures an injured person receives equitable and timely access to support, which is essential to optimising health recovery, according to the NTC.

It was considered a proportionate step given the expectation that in the short-medium term automated vehicles will represent a small proportion of the fleet.

However, the need for more substantive changes was also recognised, as insurers would also need an effective right-of-recovery mechanism to use against at-fault parties.

And there needs to be a framework to access data from automated vehicles for the purpose of determining liability.

The paper lists nationally agreed principles that should apply to automated vehicle insurance:

- Ensure no person is better or worse off, financially or procedurally, in the relevant jurisdiction if they are injured by a vehicle whose automated driving system was engaged than if they were injured by a vehicle controlled by a human driver.

- Prioritise simplicity and flexibility.

- Establish affordable, efficient and fair funding arrangements that allocate the cost of covering the liability for an automated driving system to those who can best control the risk.

- Continue reasonable and timely access to compensation regardless of the type of vehicle involved in the injury.

- Promote transparency and certainty in accessing compensation.

- Minimise potential litigation between insurers and parties at fault for injuries and deaths caused by automated driving systems.

- Promote safety innovation.

- Include efficient processes to access a standard set of reliable and verifiable vehicle crash data.

Feature image: rdmag.com

Become our friend

Find out more about Bicycle Network and support us in making it easier for people to ride bikes.